Investment Advisory Summit, Singapore 2017

2017 Event Photos

Overview

Beginning in 2010, the Investment Advisory Summits (IAS) are the largest and most important gatherings of C-suite private bankers, IAM/EAMs, and wealth managers/SFOs.

Now in their 8th year, this year’s Summits, which will attract over 800 senior leaders from the Asian wealth management industry, will be opened by the following confirmed CEOs in Singapore:

|

|

|

|

| Bahren Shaari CEO Bank of Singapore |

Francesco de Ferrari Managing Director, Head of Private Banking Asia Pacific, CEO Southeast Asia and Frontier Markets, Credit Suisse |

Michael Blake CEO Private Banking Asia Union Bancaire Privée |

Tan Su Shan Group Head, Consumer Banking and Wealth Management DBS Bank |

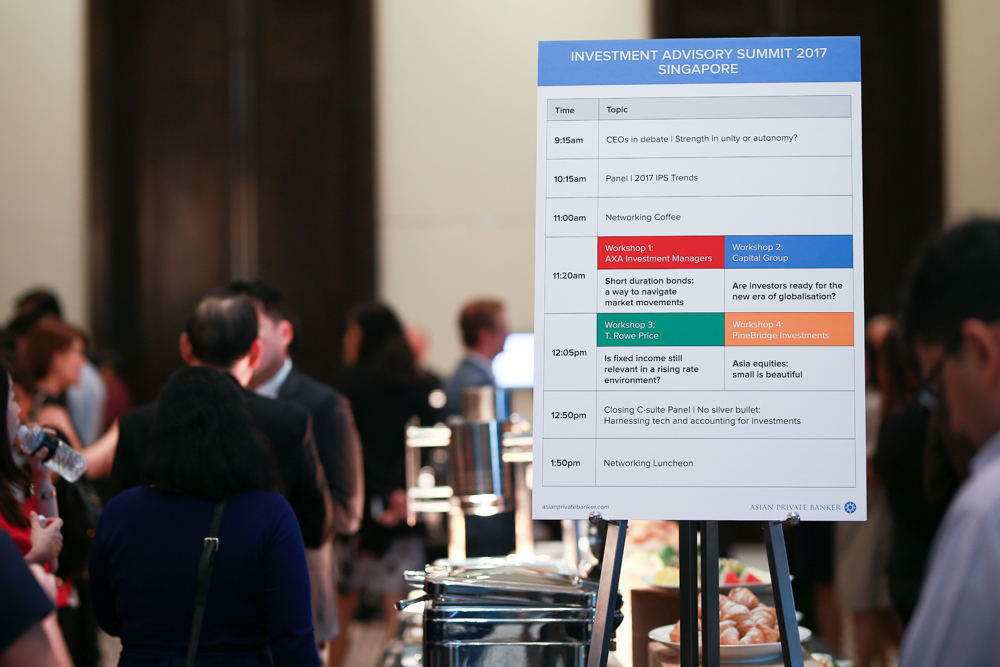

Agenda

| 8:15am – 9:00am | Registration and Networking – Foyer, Ballroom |

| 9:00am – 9:15am | Welcome Address – Ballroom |

| 9:15am – 10:15am | CEOs in debate | Strength in unity or autonomy? Is the integrated, ‘one bank’ approach to private banking better geared to meet the needs of Asia’s wealthy – many of whom remain in a wealth creation phase – or do private banks that operate as ‘independent’ business divisions or even ‘pure’ wealth managers derive key advantages from their relative autonomy? While surely not a binary dilemma, the alignment between value proposition and business model matters more than ever, as issues of scalability, regulatory tightening, independence of advice and product offering and, ultimately, business sustainability loom large in the industry. This CEO panel promises to strike at the heart of what it takes to bank Asia’s wealthy. Moderator: Conversation catalysts: |

|

10:15am – 11:00am |

Panel | 2017 IPS Trends

Private banks continue to struggle to convince Asian HNWIs to take risks or reduce their heavily overweight fixed income allocations, despite reflationary momentum driven by recovering growth and promises of political reform. But not all is lost. Clients continue to seek predictable income through fixed maturity solutions. Equity strategies focused on long-term structural thematic trends, both in public and private markets, continue to garner interest. Increasingly charitability in Asia has opened up opportunities for strategies that produce social returns or investments based on ESG best practices. What investment trends are likely to find favour with Asian HNWIs this year? Join AXA Investment Managers, Capital Group and leading wealth managers to exchange insights on how Asian HNWIs could approach a new market environment. Moderator: Conversation catalysts: Invite-only Roundtable | Structured product investing without a directional view Aversion against directional bets, market timing and asset correlation are all fears that Asian HNWIs have demonstrated as global economies shift into a less than familiar environment. Citi and Vontobel will host a small discussion of leading wealth managers examining the state of structured product appetite in Asia and how providers can help improve sentiments through effective solutions without taking a directional view. Moderators: Conversation catalysts: |

|

11:00am – 11:20am |

Networking Coffee |

|

11:20am – 12:05pm |

Workshop 1 | Short Duration Bonds: A way to navigate market movements

Investors are increasingly looking for a solution that tackles the combination of high market volatility, rising interest rate and low yield environment. Not only the effects of an unprecedented monetary stimulus, including record low government bond yields and tightened credit spreads, continuously pose difficulties for investors to secure decent returns, market volatility that fuelled by ongoing political uncertainties had also increasingly point investors to navigate in the relatively stable bond market. AXA Investment Managers offers a range of short duration strategies which aim to meet your needs, whether you are looking for a higher yield or to combat inflation. Our short duration strategies generally invest in bonds with maturities of five years or less, or expected to be redeemed/called in five years or less, and seek to capture high current income with low overall volatility and the potential of providing attractive risk-adjusted return. Workshop host: Workshop 2 | Are investors ready for the new era of globalisation? Is the world de-globalising? News headlines suggest so. Global trade growth has slowed. The new US administration’s decisions to withdraw from the Trans-Pacific Partnership and consider border taxes are further examples of a shift towards protectionism. But there are good reasons to believe that globalisation is simply entering a new chapter. We discuss what the changing environment means for companies, and how investors can position their portfolios to benefit. Workshop hosts: |

| 12:05pm – 12:50pm |

Workshop 3 | Is Fixed Income Still Relevant in a Rising Rate Environment?

The U.S. Federal Reserve is increasing short-term interest rates and the European Central Bank has begun to taper their bond purchase program. U.S. President Trump promised tax cuts, infrastructure spending, and deregulation even though the U.S. economy is operating near full employment. Will the reduction in monetary policy accommodation and potential increase in inflation cause losses for fixed income investors or are there investment strategies which can provide stable income and preserve capital? We will discuss the history of rising interest rate cycles, why this time may be different, and strategies that global investors are using today to diversify and protect their portfolios. Workshop host: Workshop 4 | Asia Equities: Small is Beautiful Some of the greatest corporate transformations driven by technology are occurring in Asia, a region that is now similar in size to the United States in terms of nominal GDP. An on-the-ground research presence in Asia and a thorough knowledge of company strategies and managements are among the key success factors in realizing one of the largest alpha opportunities in global equity markets, particularly among many hundreds of investable, high-quality, under-researched small and mid-cap stocks in Asia. We will also discuss why in this third and final phase of the market’s normalization after the great financial crisis, asset owners are likely to increase their investment allocation to equities and to embrace a more active stance. Workshop host: |

|

12:50pm – 1:50pm |

Closing C-suite Panel | No silver bullet: Harnessing Tech and accounting for Investments

Now more than ever, technology occupies a central role in Asia’s private banking industry. Tech is a key ingredient in cost-cutting strategies, while the region’s burgeoning fintech ecosystem is giving rise to innovative solutions that promise to automate manual processes. Still, there is little-if-any consensus as to what an ‘ideal’ tech strategy looks like and even less insight on how ROI should be measured – if at all. How can the industry ensure that its tech investments payoff and how can smaller players harness the tech wave in a sustainable and profitable manner? Moderator: Conversation catalysts: |

| 1:50pm – 3pm | Networking Luncheon |

Advisory Council

Arjan De Boer

Head of Markets and Investment Solutions, Asia

CA Indosuez

Aman Dhingra

Head of Multi-Asset Research Asia

UBP

Angel Wu

Regional Head, Products & Solutions, Asia and Middle East

ABN ARMO Private Bank

Belle Liang

Head, Investment Advisory

Hang Seng Private Bank

Claude Harbonn

Head of Investment Consulting Singapore

Credit Suisse

Jansen Phee

Head Content Management APAC, Head Program Module Management APAC, Investment Management

UBS Wealth Management

Lim Soon Chong

Regional Head, Investment Products & Advisory

Consumer Banking Group & Wealth Management

DBS

Mischa Eckart

Head of Client Investment Specialists APAC

UBS Wealth Management

Patrick Donze

Head Advisory Portfolio Management

Bank of Singapore

Richard Mak

Head, Advisory Services, Asia

Pictet & Cie

Sascha Banz

Head of Investment Consulting, Greater China

Credit Suisse

Simon Ip

Head of Markets & Investment Solutions, Singapore

Indosuez Wealth Management

Stefan Lecher

Head IPS Client Portfolio Management APAC

UBS Wealth Management

Partners

Lead Partners

|

|

Conversation Partners

|

|

|

|

Inquiries

For further information, please contact: [email protected]